For many aspiring homeowners, the dual goals of saving for retirement and a down payment on a first home can feel like a financial tightrope walk. The good news is, under certain circumstances, your retirement savings can give you a significant boost toward homeownership. However, before you start earmarking those funds, it’s crucial to understand the rules and tax implications to avoid any costly surprises.

This comprehensive guide will walk you through the various ways you can tap into your retirement accounts to help purchase your first home, ensuring you make an informed decision that aligns with your long-term financial goals.

Individual Retirement Accounts (IRAs) are often the go-to for first-time homebuyers looking to access their savings. Here’s a breakdown of how it works for both Traditional and Roth IRAs.

Tapping into an employer-sponsored plan like a 401(k) is also a possibility, though the options differ from IRAs.

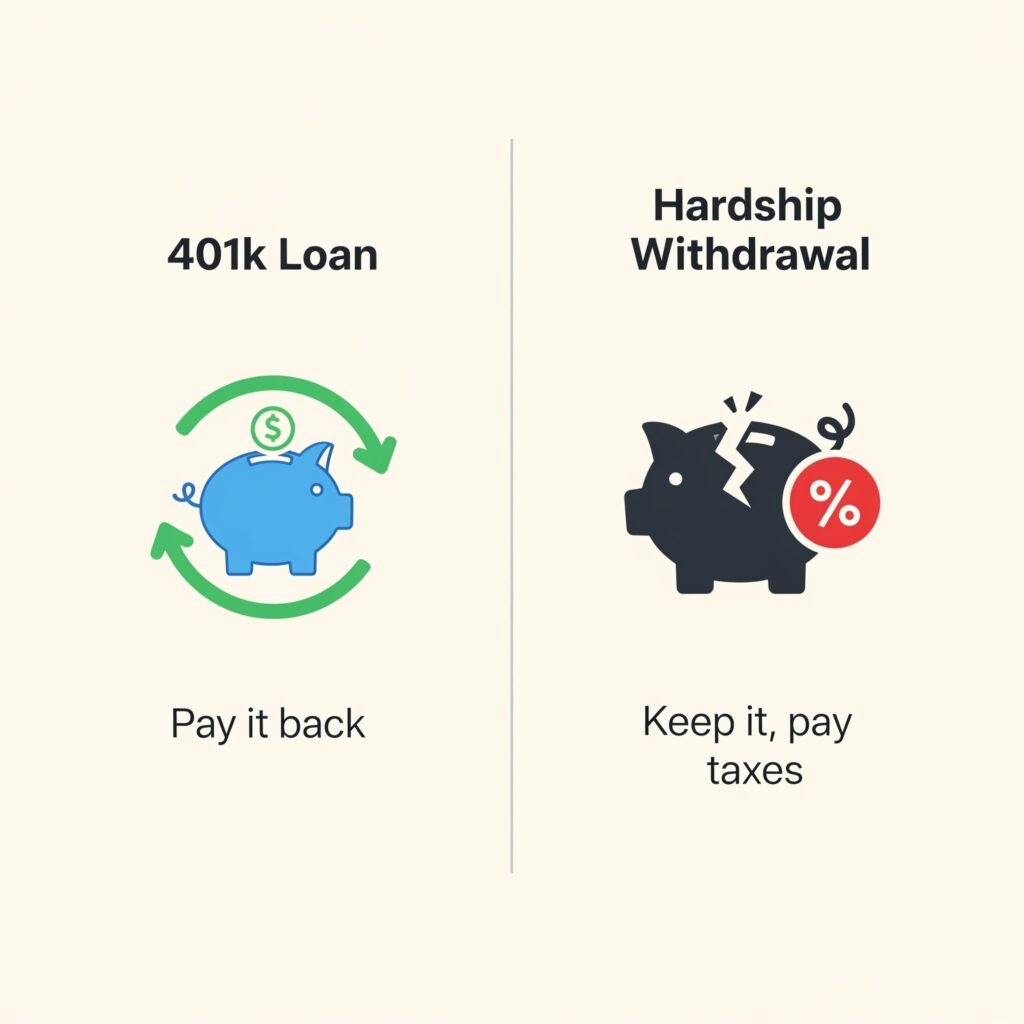

Many 401(k) plans allow for hardship withdrawals for the purchase of a principal residence. To qualify, you must demonstrate an “immediate and heavy financial need.” A home purchase often meets this criterion. You will need to provide your plan administrator with documentation to support your request. Hardship withdrawals are subject to both income tax and a 10% early withdrawal penalty if you are under 59 ½.

A 401(k) loan can be a more attractive option. A key difference is that you are borrowing from yourself and must repay the loan, with interest. Typically, you can borrow up to 50% of your vested account balance (max $50,000) and repay it over five years through payroll deductions. However, if you leave your job, the loan may become due in full. Defaulting will result in it being treated as a taxable distribution, including the 10% penalty. Also, while you are repaying the loan, that money is not invested and growing in your retirement account.

Before you make a final decision, here are some additional factors to keep in mind.

The funds you withdraw can be used for more than just the down payment. Qualified acquisition costs include: closing costs, settlement fees, and financing fees.

If you are married and both you and your spouse are first-time homebuyers, you can each withdraw up to $10,000 from your respective IRAs for a total of $20,000.

Remember that in addition to federal taxes, your withdrawal may also be subject to state income taxes. The rules vary by state, with some states having no income tax at all. It is essential to research your state’s specific laws or consult with a tax professional.

Before dipping into your retirement savings, it’s wise to explore other programs designed to help first-time homebuyers, such as FHA Loans, VA Loans, state and local programs, or employer assistance. Consider building your down payment through other means as well, such as high-yield savings accounts, short-term CDs, or money market accounts.

Proper planning and paperwork are crucial. You will likely need to file IRS Form 5329 to claim the exception to the early withdrawal penalty. For Roth IRA distributions, you may also need to file Form 8606. Keep meticulous records of your withdrawal and how the funds were used for your home purchase, and be mindful of the calendar year and tax year implications.

To better understand the financial implications, let’s look at a few scenarios.

The decision to use retirement funds for a home purchase is a significant one with long-term consequences. This guide provides a solid foundation, but it’s essential to consult with a qualified financial advisor or CPA. They can help you navigate the complexities of tax laws, evaluate your individual financial situation, and create a strategy that allows you to achieve your dream of homeownership without sacrificing your future financial security.