Starting a new business is an exciting venture filled with passion and creativity. However, even the simplest business structures come with complex tax rules, where an honest mistake can quickly lead to a major financial headache. This case study shows how we helped a new partnership clear a stressful IRS notice, allowing them to focus on what they do best.

Two creative entrepreneurs who formed a partnership to launch their new local business, a hands-on craft studio.

During their first year, the partners were focused on securing a location, sourcing materials, and building their brand. Their new partnership had only startup expenses and had not yet generated any income. Believing a tax return was only required if they had profits, they were unaware of their obligation to file a partnership return (Form 1065).

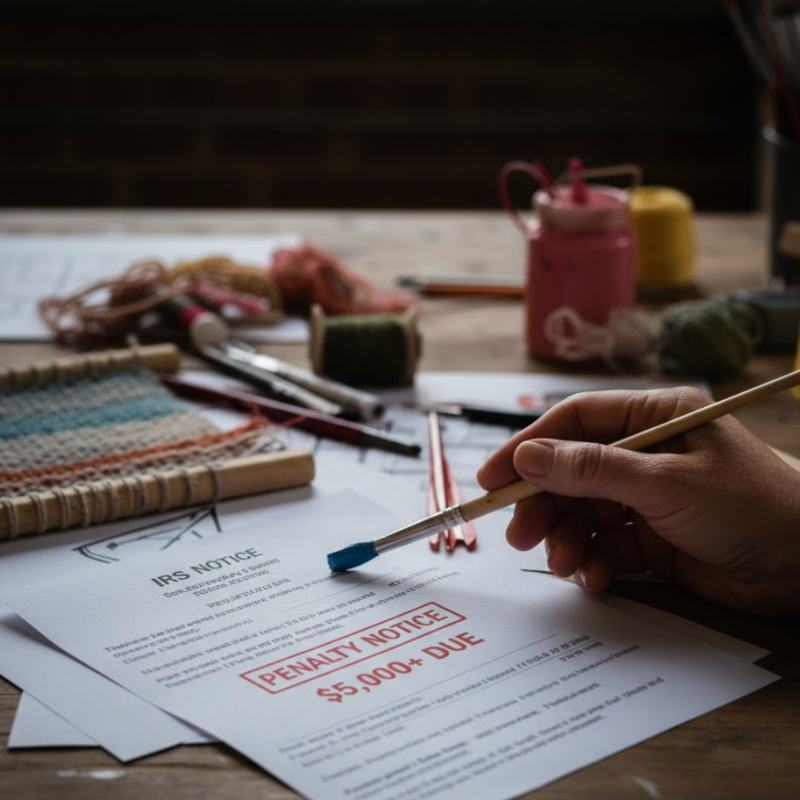

A year later, as they were preparing to open their doors to the community, they were shocked to receive an official notice from the IRS assessing over $5,000 in late-filing penalties. The notice was intimidating and threatened to derail their launch, and they didn’t know where to turn.

The partners came to us with the notice, and we immediately developed a plan to address it. Our process was methodical and focused on achieving a full resolution:

Thanks to our direct intervention and detailed request, the IRS removed the entire penalty of $5,701, bringing the partnership’s account balance back to zero.

The partners avoided a significant financial burden that could have impacted their grand opening. They now have a clean slate with the IRS and a clear understanding of their annual tax obligations, allowing them to pour all their energy into successfully launching their new craft studio with confidence and complete peace of mind.